Building Financial Trust

We are building a transparent and reliable system where your digital assets work for you. Our goal is to provide stable returns for crypto holders while giving businesses access to the financial resources they need for growth and development.

Join a multi-tier affiliate program and earn passive income by referring new users. Grow your earnings effortlessly in the evolving

grow your business

How It Works?

A straightforward and secure roadmap designed to maximize your digital asset returns with complete transparency.

Cryptocurrency owners lend their assets through our platform, forming a single pool of funds.

Granthera turns digital assets into loan capital, which is used to fund the credit needs of businesses.

Our team of experts conducts thorough credit assessments of borrowers, minimizing risk and securing transactions.

All processes are automated and strictly controlled using modern technology, ensuring complete transparency and protection of your funds.

Owners of digital assets receive regular payments in accordance with pre-agreed terms, allowing them to earn a stable income on their funds.

Boost returns by strategically allocating your digital assets!

Why Crypto Lending is the Future

Crypto lending is rapidly gaining popularity due to its speed, accessibility, and flexibility. Here’s why more businesses are choosing this method of raising capital:

Unlike traditional bank loans, obtaining a crypto loan is much faster and does not involve complex bureaucracy.

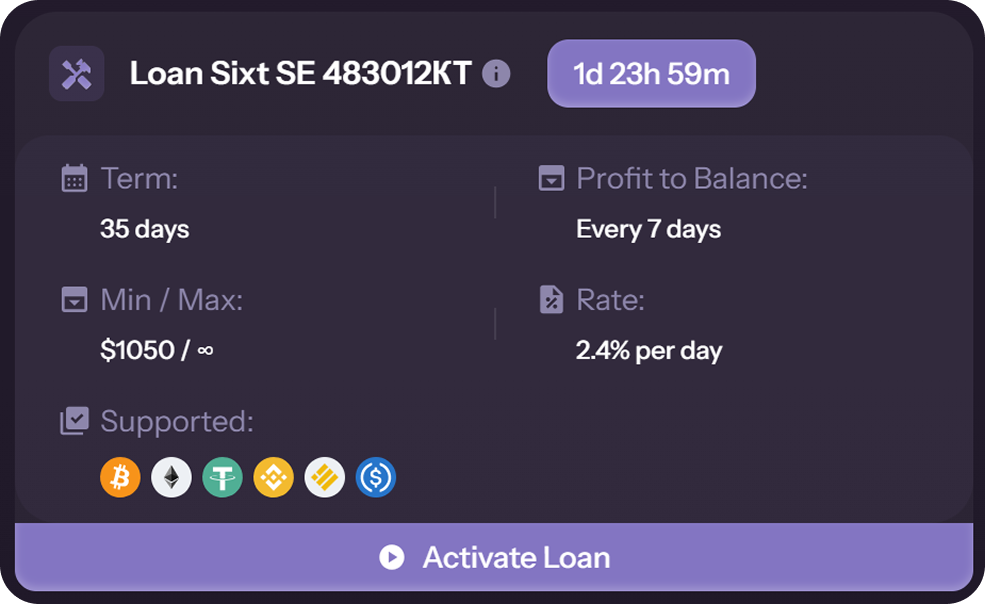

Businesses can select optimal loan parameters (amount, duration, interest rate) without stringent credit history or collateral requirements.

Cryptocurrency is not tied to a specific country, allowing businesses to attract funding worldwide without restrictions.

More companies are recognizing cryptocurrency as not only an investment asset but also a viable tool for transactions and lending.

Decentralized finance (DeFi) is unlocking new opportunities for lending, liquidity, and automated capital management, making crypto lending even more efficient and secure.

Our Solutions

We provide flexible tools for working with digital assets that allow you to

Secure earnings anytime

Earn stable income even in times of market uncertainty.

Grow with crypto

Maximize the potential of cryptocurrency to support capital growth.

Trust in innovation

Benefit from transparency and reliability, backed by cutting-edge technology.