How It Works?

At Granthera, we provide a comprehensive approach to managing your digital assets: from capital formation and fund allocation to interest payments and transparent oversight at every stage. You choose the deposit plan that suits you best, while we handle professional management, risk assessment, and asset security.

Your digital assets are combined into a single pool, which is then distributed across various companies and loan programs. This model allows for the efficient use of collective capital and directs it to the areas with the highest potential returns.

Our team of experts carefully analyzes each company and potential borrower, assessing their creditworthiness and growth prospects. We use advanced technologies and automated monitoring systems to track performance in real time and adjust strategies when necessary. This approach ensures high transparency and helps minimize risks.

All transactions are protected by cutting-edge security protocols and blockchain technology, preventing unauthorized access to your assets. We implement reserve mechanisms and proven encryption algorithms, ensuring your funds are securely managed and allocated exclusively to verified companies.

Each deposit plan focuses on a specific economic sector (such as real estate, small businesses, transportation, startups, or P2P lending). This diversified allocation helps reduce overall risk, as profits and risks are spread across multiple areas.

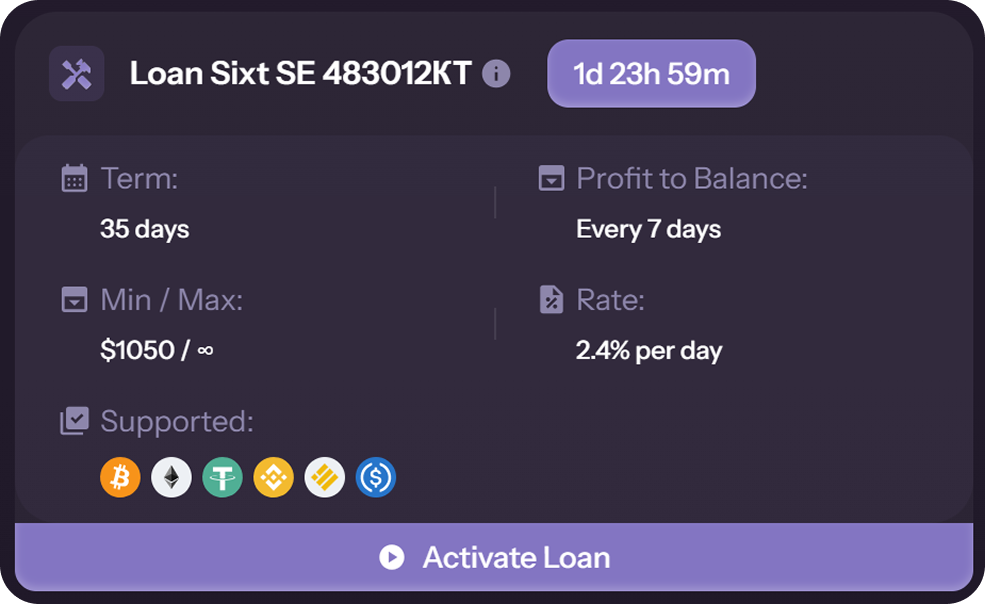

Interest is paid according to the terms of the selected deposit plan. Earnings are either accrued at the end of the deposit period or periodically, depending on the agreement. The returns are generated from the profits earned by the funded companies, meaning that the more efficiently the loan programs operate, the higher the potential return for depositors.

The fixed deposit duration is aligned with the financing cycle of the companies and loans your assets support. For example, if a business takes a loan for 5, 30, 60, 160 or 180 days, your deposit follows the same period.

This provides:

Predictability: You know when you can withdraw funds and receive earnings.

Risk Control: Funds work within defined companies, not locked indefinitely.

Stability: Fixed terms allow performance reviews and reinvestment opportunities.

At Granthera, you select the deposit plan that fits your goals, while we ensure professional management, risk control, and asset security.

Boost returns by strategically allocating your digital assets!

Where the Money Goes

The borrowed funds at Granthera are allocated across carefully selected sectors of the economy. We ensure efficient distribution of resources so that the funds contribute to stable returns and support real business growth.

Each direction varies in terms of duration, risk level, and application of borrowed funds. Through diversification, we reduce risks and enhance the financial stability of the companies we finance.

Below you’ll find cards with brief information about the key sectors where our clients’ borrowed funds are directed:

Medium term loans

Short term loans

Short term loans

frequently

asked questions

Have questions? We’ve got answers! Find everything you need to know about our deposit plans, security measures, and investment process.

Your digital assets are pooled together and allocated to verified business companies and lending programs. This allows for efficient capital use and the potential to generate profits.

Your funds are managed by Granthera's team of experts. They analyze each company, assess borrowers' creditworthiness, and use modern technology for real-time monitoring and strategy adjustments.

We use up-to-date security protocols, blockchain technology, and encryption algorithms. Your funds are protected and only used for financing approved and verified companies.

Diversification means spreading funds across different industries (such as real estate, small business, transport, etc.). This reduces overall risk and improves portfolio stability.

The term matches the financing period of specific companies (usually 5, 30, 60, 160 or 180 days). This ensures predictable payouts, effective risk management, and the option to reinvest once the term ends.