The crypto lending market is rapidly maturing. Here are the key trends that will shape it over the next 2–3 years:

1. Rise of Institutional Platforms

Banks, hedge funds, and major fintech companies will launch their own crypto lending services. Expect hybrid CeFi+DeFi models with robust security and clear legal frameworks.

2. Regulatory Frameworks Become Standard

MiCA in Europe, SEC in the U.S., and new legislation in Asia—by 2026, most major jurisdictions will establish formal rules for crypto loans. This will attract institutional players and fuel a fresh wave of liquidity.

3. More Collateral in Stable Assets

Loans will increasingly be backed not just by Bitcoin and Ethereum, but also by stablecoins (USDC, EURC, PYUSD) and tokenized real-world assets (bonds, real estate, gold).

4. Industry-Specific Crypto Lending

Crypto loans will gain traction in business sectors—from IT to logistics and construction—especially in emerging markets where traditional banks are less flexible.

5. AI and Risk Management Integration

Automated scoring models will emerge, assessing collateral risks and interest rates in real time, making lending platforms more secure and efficient.

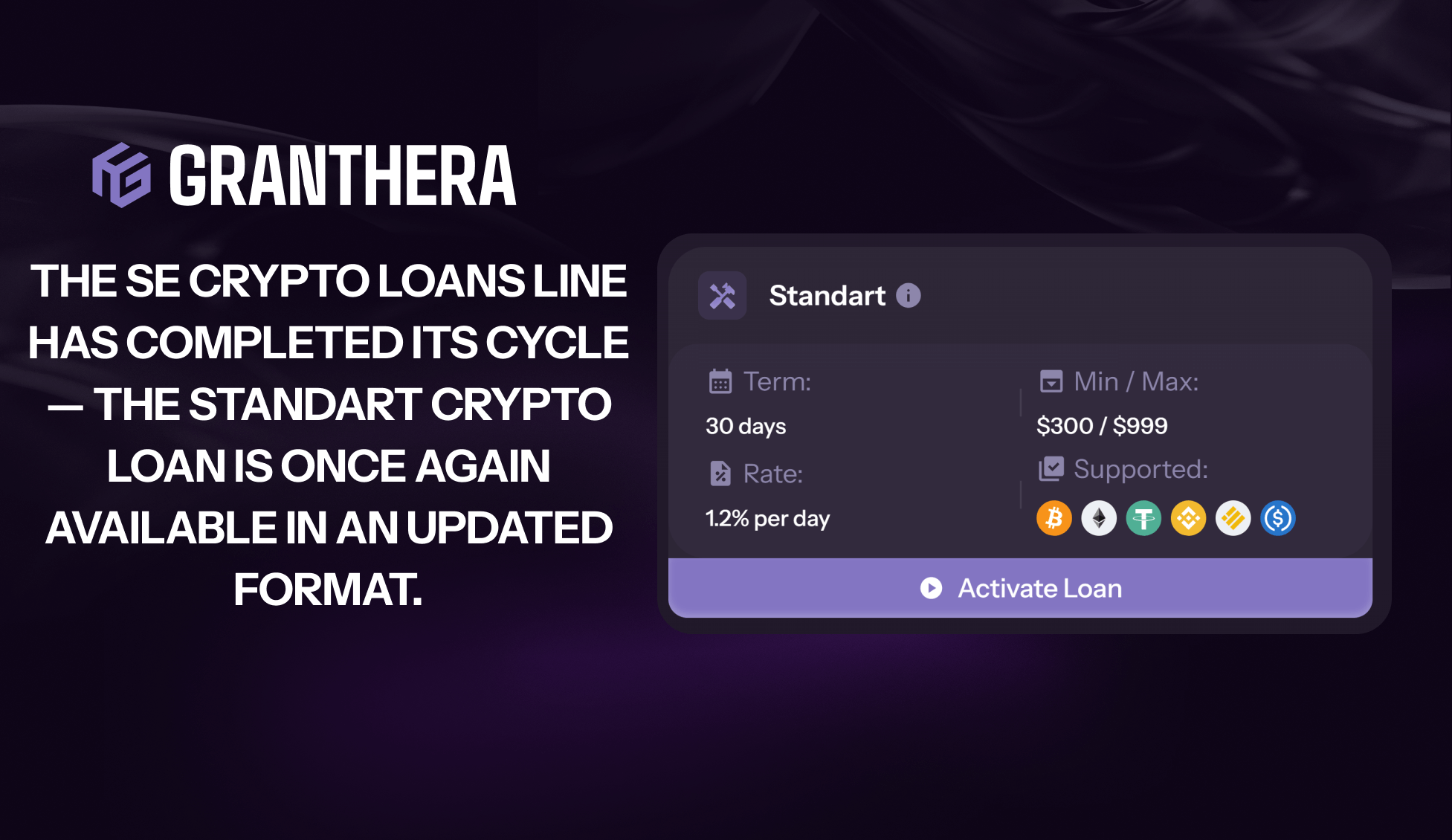

The Bottom Line:

Crypto loans are evolving into a mature component of the global financial system—transparent, fast, and accessible.