Following its partnership with Broad Group, the Broad Crypto Loan product is reaching a new financial level. The company reports growth in operational performance and a transition of the program to a corporate financing architecture.

As Alexander Kornev noted, the combined effect of the deal and current market dynamics has enabled the product to move into a category of solutions with expanded capabilities and enhanced resilience standards.

Increased participation volumes following the Broad Group deal have created conditions for transitioning to a more mature financial model. As part of the infrastructure update, the product now features:

A new capital management architecture;

Corporate-level control and planning;

Greater resilience through large structural flows;

Expanded parameters for working with credit limits.

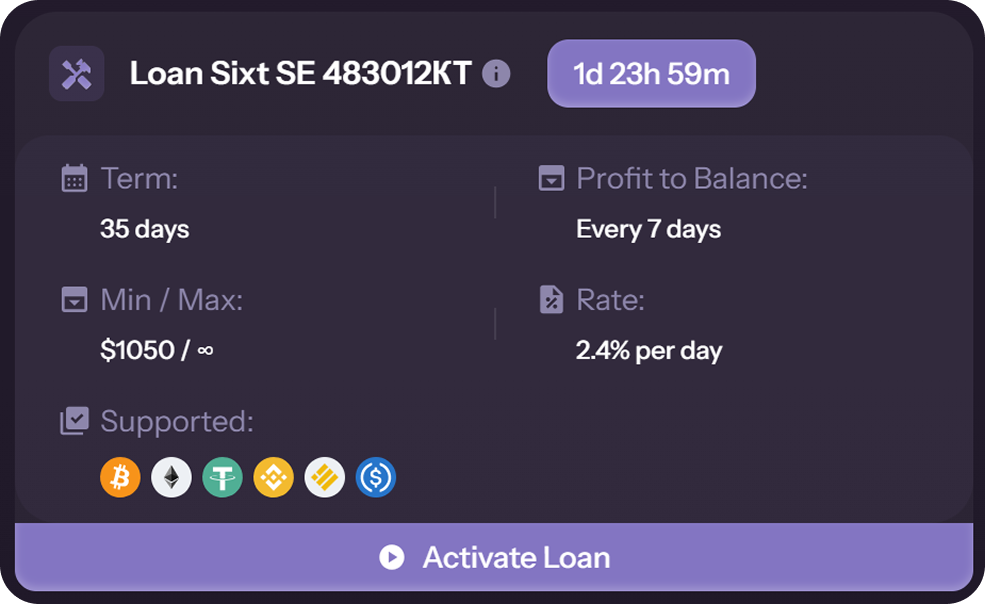

The minimum participation threshold has been adapted to the new model—it is part of systemic expansion, not a restrictive measure.

For partners:

Stronger product. The new financial architecture improves reliability horizons and enhances the quality of the overall model.

Increased participation level. Partners become part of the corporate financial segment, with higher standards and more stable results.

Predictability. The model now benefits from a smoother, more structured capital flow and a predictable operational cycle.

Better protection of interests. Updated mechanisms provide the system with long-term resilience.

For the company:

Transition to a corporate financing model;

Increased resilience of the credit program;

Access to larger-scale management tools;

Strengthening the strategic foundation for further growth.

The Broad Crypto Loan’s transition to corporate financing is a natural stage in the product’s evolution. The updated architecture makes the program stronger, more stable, and more advantageous for all active participants.