Granthera announces the phased integration of the Digital Ruble as a new payment infrastructure.

The system is planned to enter full-scale industrial operation in 2026.

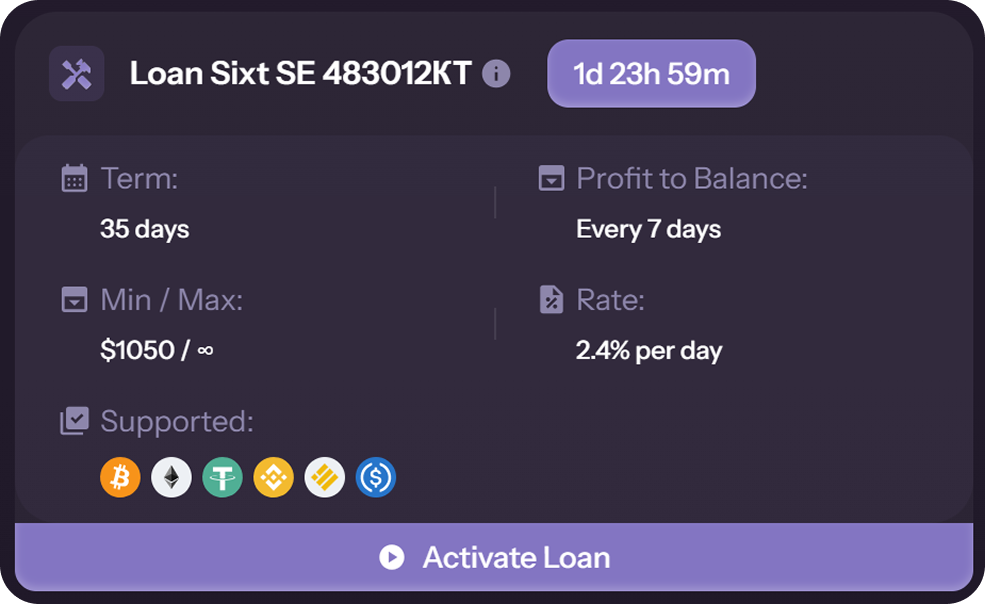

The company announces the launch of a special program for clients: when obtaining loans, a cashback of 1% of the loan amount will be credited. This cashback serves as a functional financial instrument that provides enhanced flexibility in capital management.

Granthera’s participation in the official pilot project for testing the Digital Ruble made this program possible. Key components of the CBDC infrastructure have already been integrated into the company’s technological architecture, allowing Granthera to operate as a full testing participant and provide clients with access to advanced tools of the digital financial ecosystem. This integration confirms the company’s readiness to operate in accordance with new regulatory standards and strengthens its overall operational resilience.

“Granthera is undergoing large-scale transformational processes. Our strategic mission is to build a sustainable infrastructural bridge between Web3 innovations and the regulated financial environment,”

— Alexander Kornev, CEO of Granthera, closed conference, 21.11.2025.

The cashback program for Digital Ruble operations is available exclusively to Granthera partners.