London, September 17, 2025 – The UK Financial Conduct Authority (FCA) has announced the launch of a new regulatory model for cryptocurrency companies. The initiative aims to reduce excessive administrative burdens and create a more flexible infrastructure for the development of the digital asset market.

For Granthera, this means confirmation of the correctness of its chosen business model and consolidation of its position in the digital financial services market.

What’s changing?

The FCA is moving away from a universal banking regulatory model toward an adaptive approach tailored to the specifics of the cryptocurrency market. This is not about reducing oversight, but about implementing targeted supervisory mechanisms that ensure a balance between innovation and financial system stability.

Why it matters for investors:

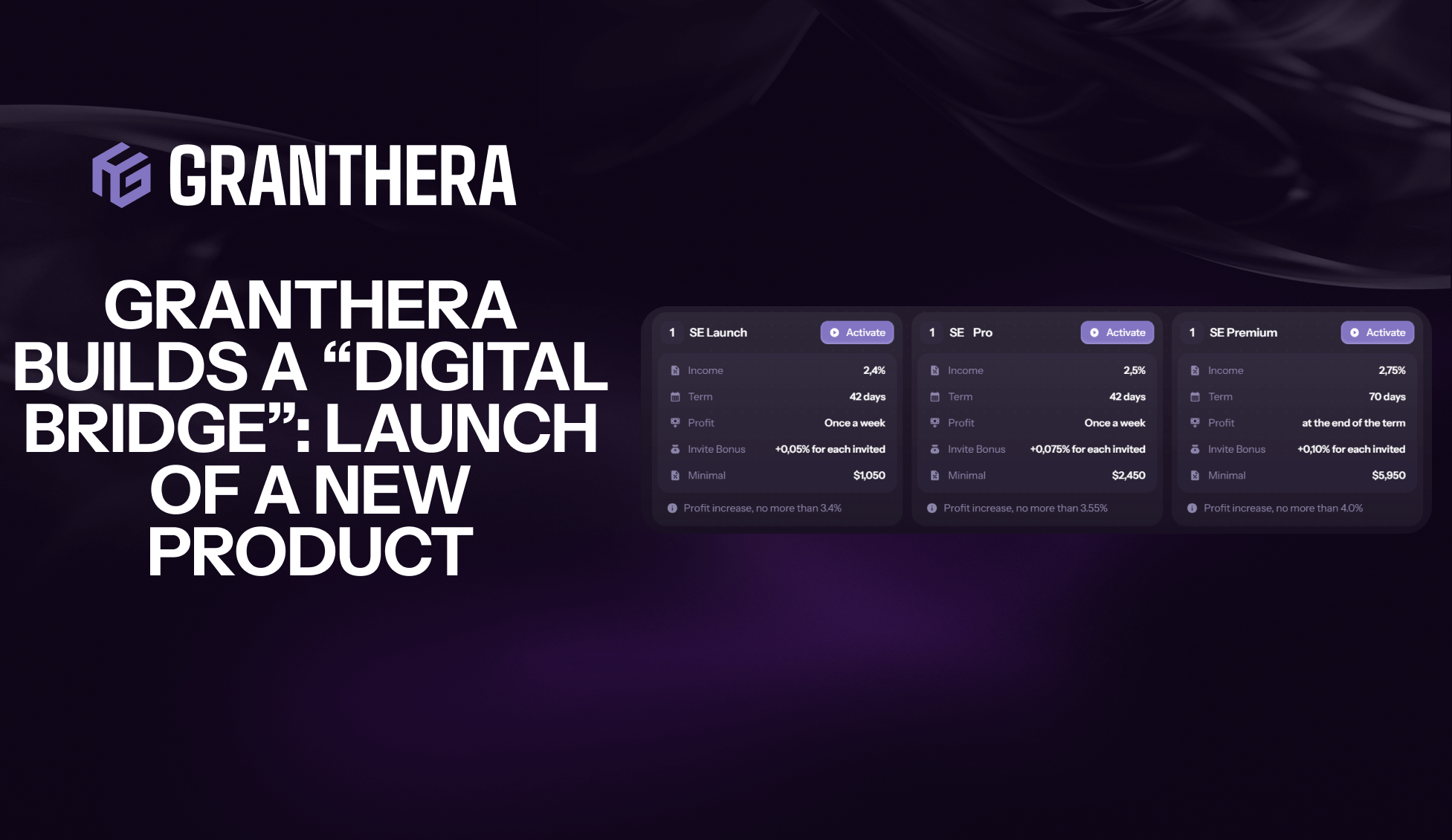

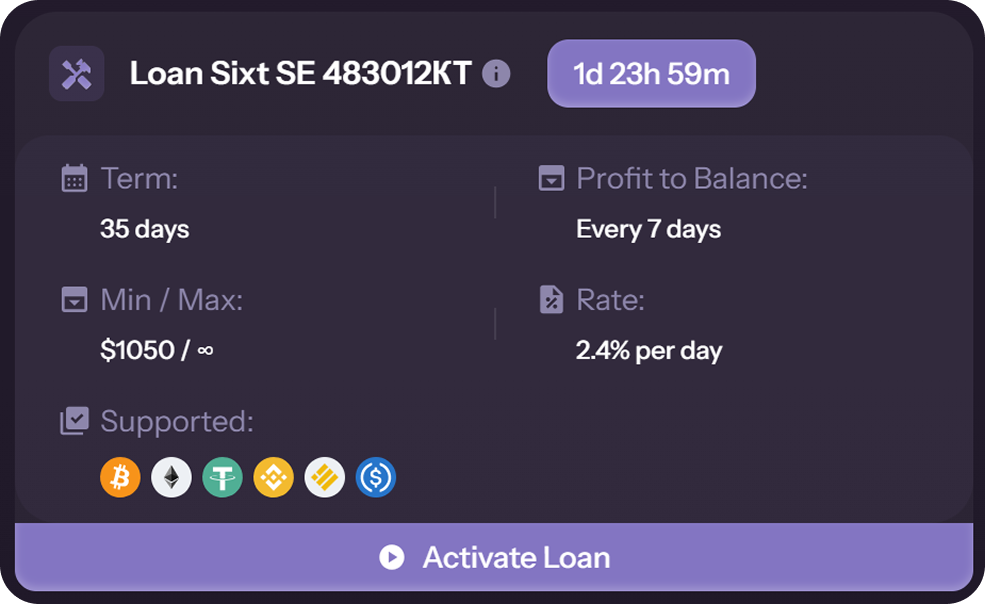

Increased profitability: Reduced regulatory barriers allow new products to reach the market faster.

Technological advantage: Blockchain and smart contracts lower costs and ensure transaction transparency.

Legal protection: The industry is moving out of the “gray zone,” which increases trust and reduces risk.

Faster capital turnover: Less bureaucracy means faster transactions and higher investment liquidity.

Granthera Among the Drivers of New Regulatory Trends

The FCA initiative simplifies regulatory requirements, creating conditions for more efficient company operations. Granthera leverages this to strengthen its financial solutions portfolio, increase returns for investors, accelerate innovation adoption, and drive business growth.