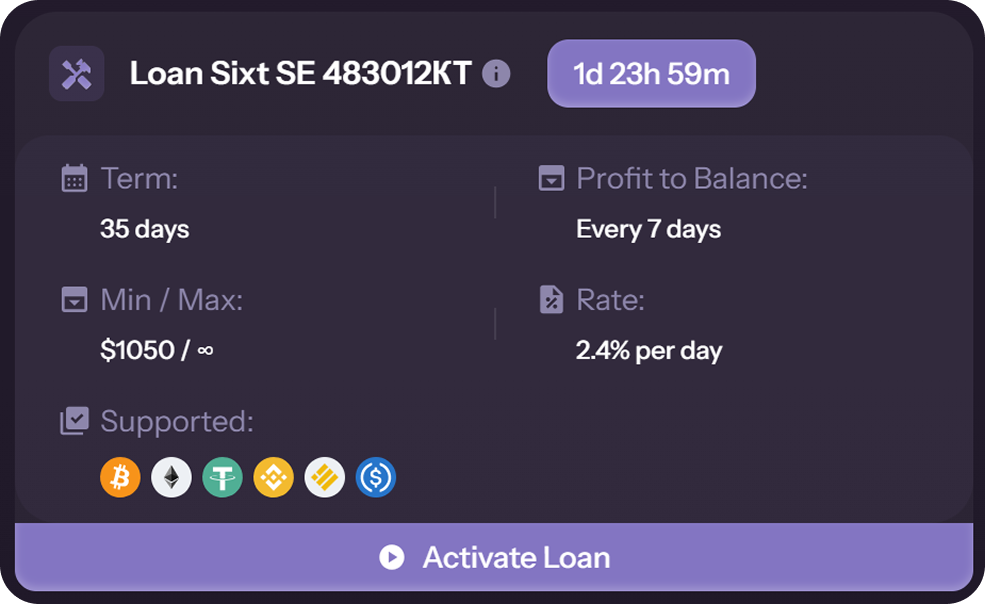

Granthera Group offers a well-considered approach to structuring fixed-term deposits. Unlike conventional market offerings, our deposit products are aligned with the actual financing cycles of companies and loans in which your capital is invested.

How It Works:

When a business receives financing for 5, 30, 60, 160, or 180 days, your deposit is structured for the same term. This is not just flexibility — it’s precise alignment with real-world financial logic.

Key Benefits for Investors:

Predictability

You know in advance when the cycle will end and when you’ll receive your return, with no unexpected delays or unclear rollovers.

Risk Control

Your capital isn’t locked up indefinitely — it works within defined, transparent credit projects.

Financial Stability

Fixed durations allow you to consistently evaluate performance and reinvest strategically.

Granthera combines professional asset management, strict risk oversight, and security standards that meet the demands of the digital economy.

When you choose a Granthera deposit product, you’re not simply investing — you’re selecting a financial instrument grounded in logic, transparency, and strategic thinking.

Granthera — a partner trusted for long-term financial decisions.