Granthera Group experts conducted a study and identified a clear long-term trend: more and more Europeans are abandoning traditional banking products in favor of digital solutions.

Key findings:

— The shift is particularly active among people aged 30 up to retirement age;

— Growth drivers include inflation, market fluctuations, and the increasing accessibility of fintech;

— Digitalization is spreading across all segments — from major cities to small towns.

What Europeans are choosing:

• 24/7 capital management;

• Transparent analytics and personalized recommendations;

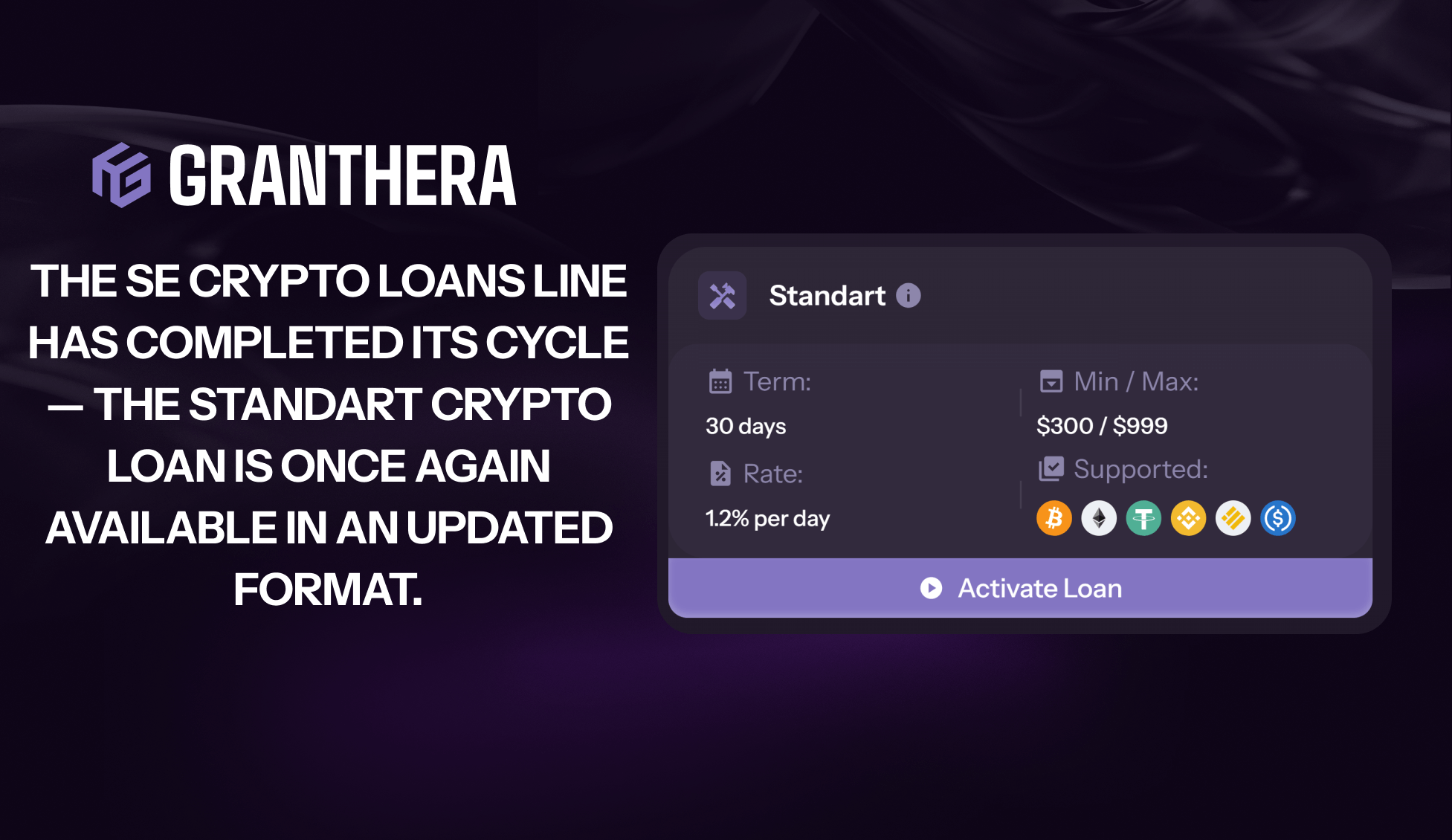

• Working with cryptocurrency and smart contracts.

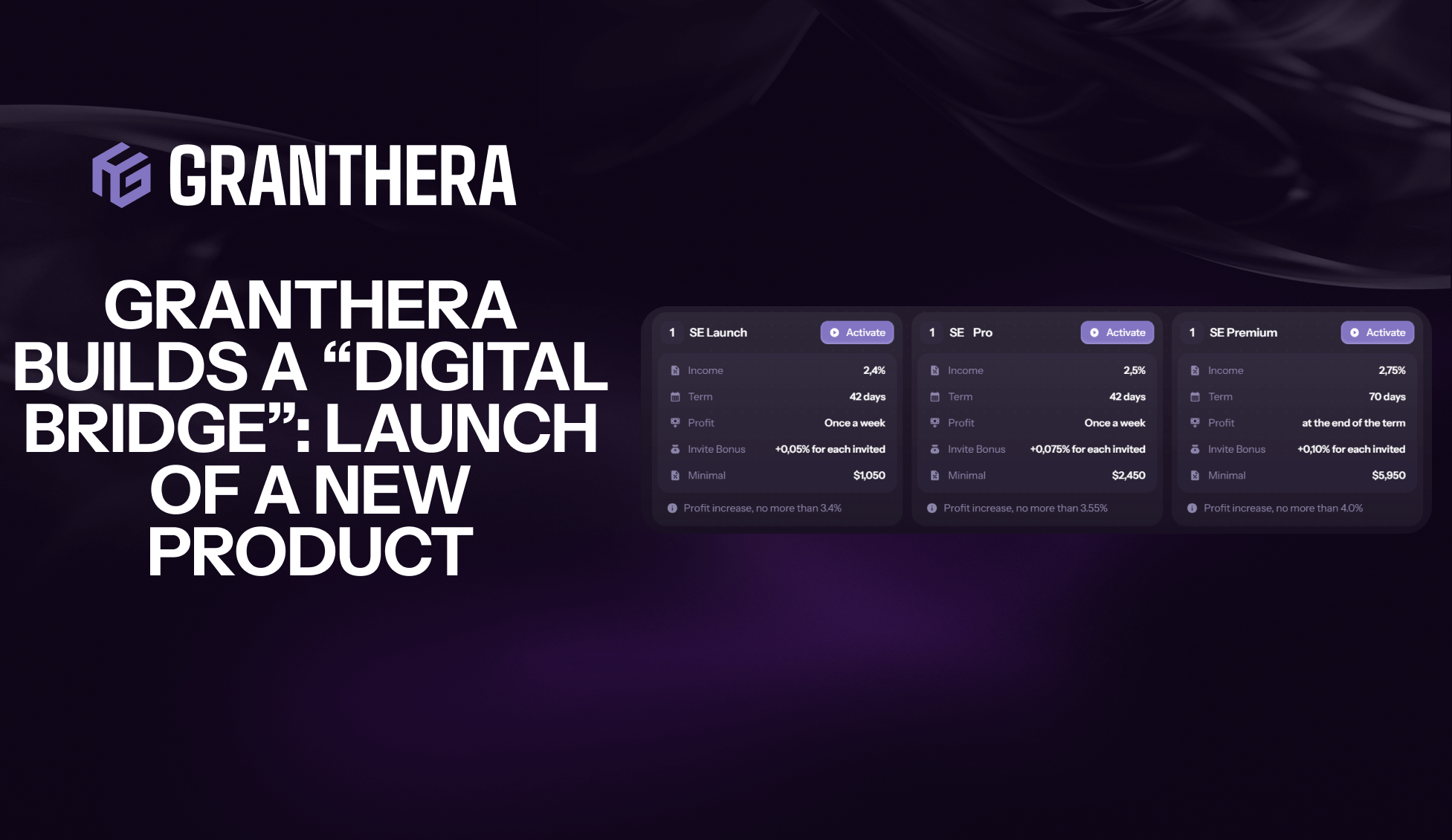

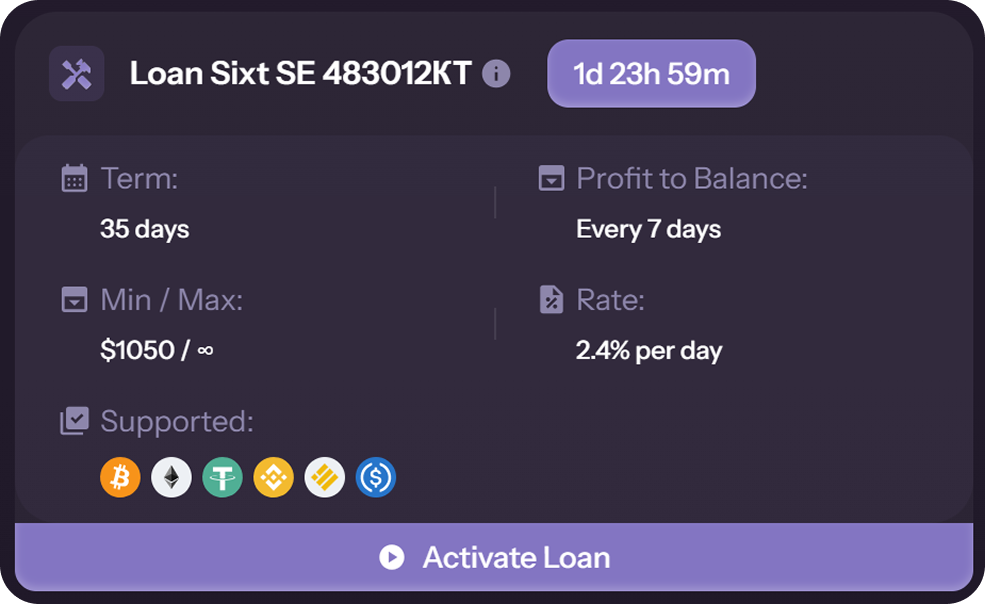

Among the companies mentioned by participants are both national and international players, including Granthera Group, which develops cryptocurrency lending technologies and personal financial analytics.

Experts are confident: the digitalization of finance in Europe is not a short-term trend, but a long-term prospect.