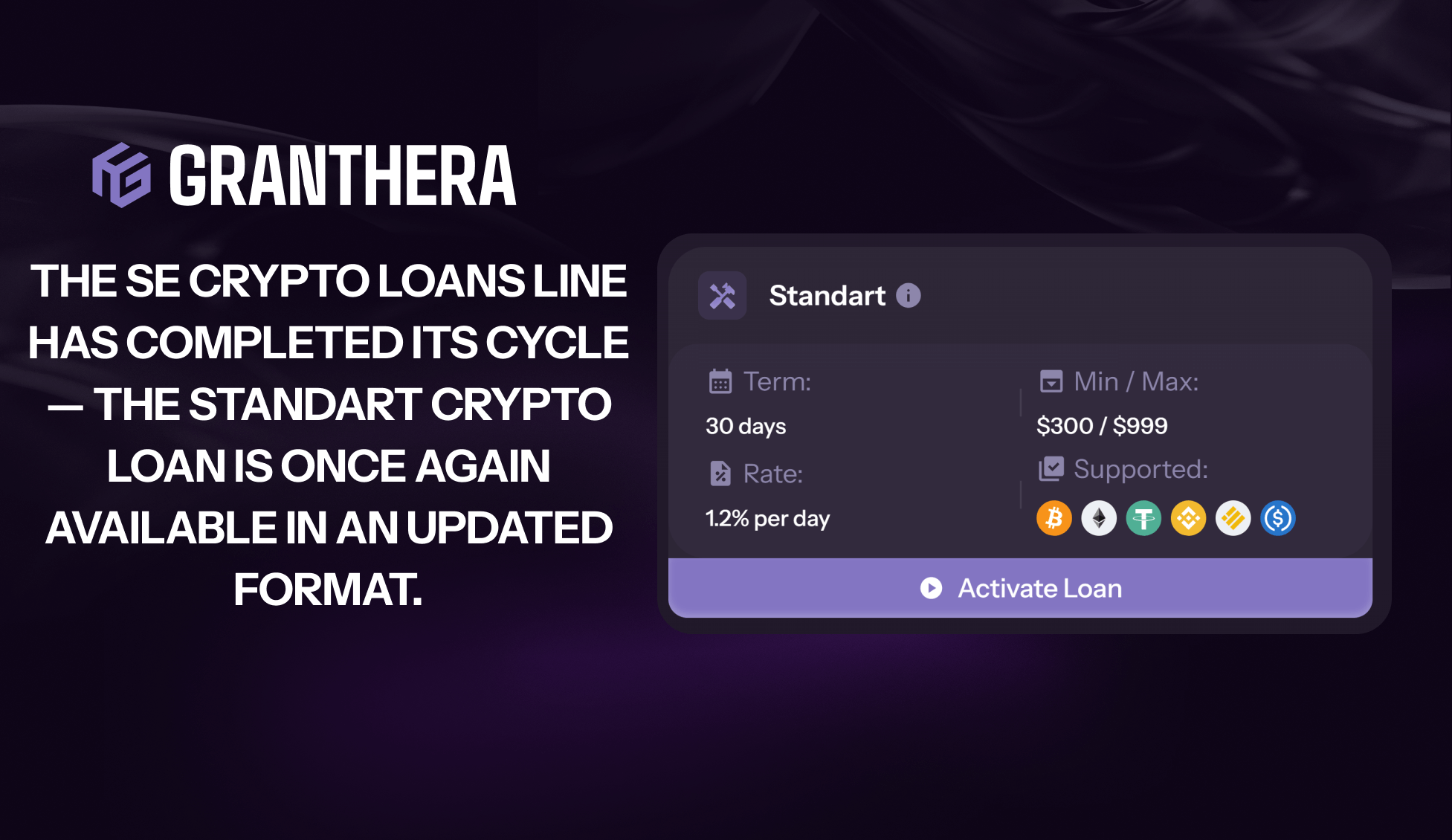

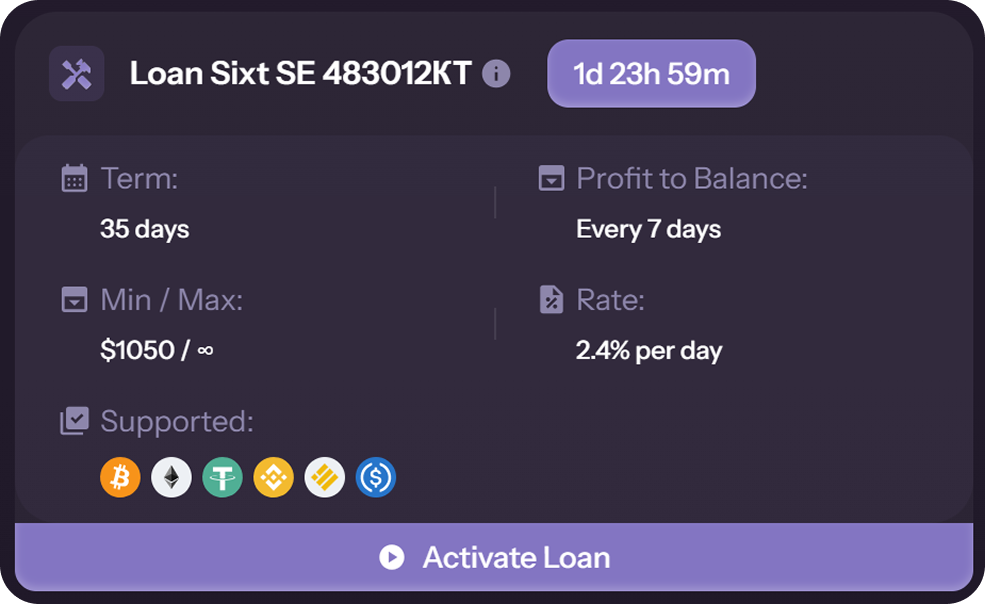

Granthera announces the launch of crypto loans for individual clients. This is not just a product — it’s a strategic move that elevates the crypto industry from niche solutions to a mainstream, retail-ready financial instrument.

Key Benefits for Borrowers:

- Liquidity without selling assets. Access capital while keeping BTC, ETH, and other assets in your portfolio. Your holdings continue to grow while you use the borrowed funds.

- Speed and transparency. Smart contracts automate the process: application, verification, and fund transfer take just minutes. No hidden conditions — only a clear, structured deal.

- Global access and confidentiality. Loans are available 24/7 from anywhere in the world. Minimal personal data, maximum efficiency.

- Bypassing traditional banking barriers. Credit history or income verification is irrelevant. The decision is based solely on your crypto assets.

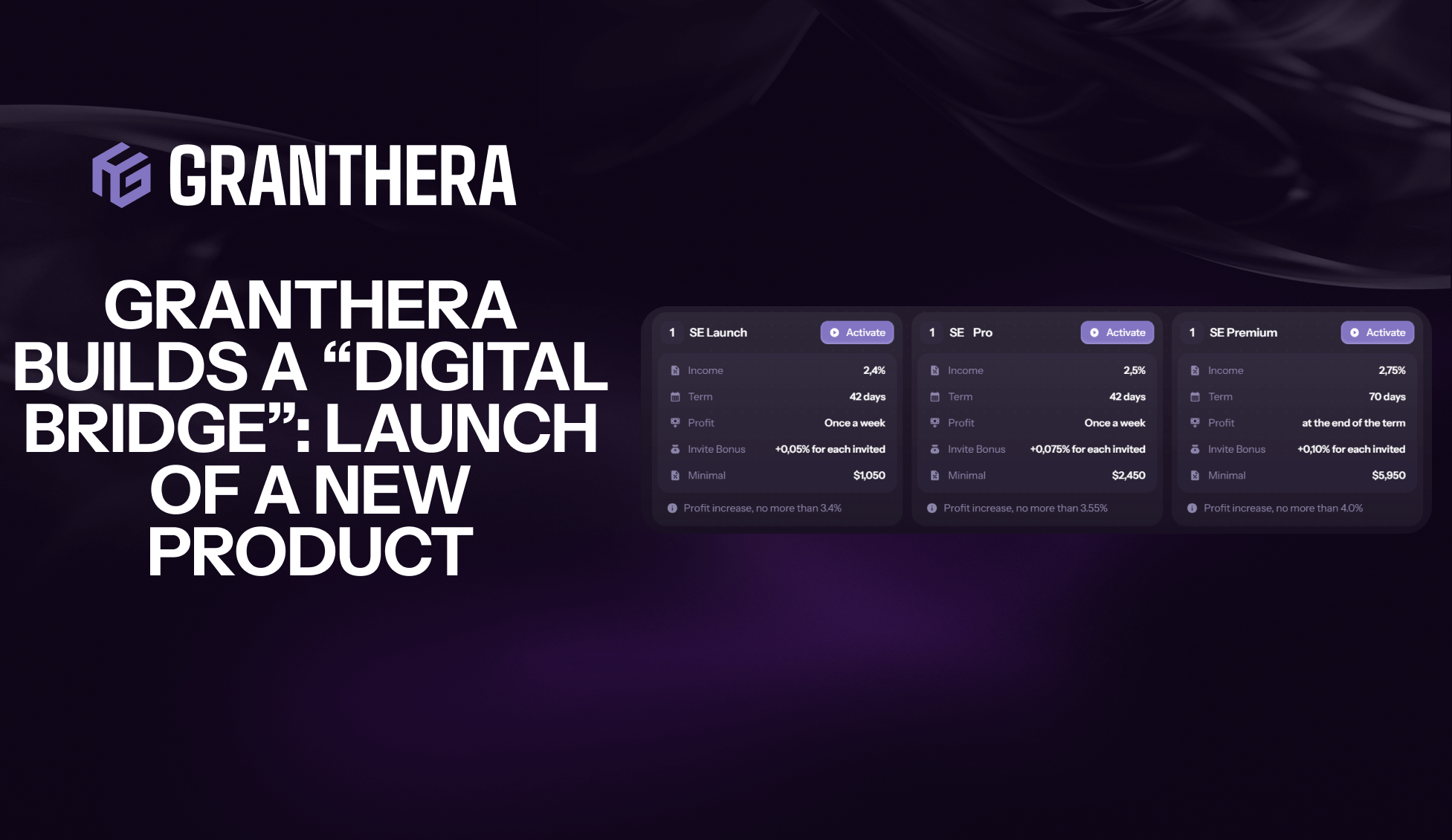

What this means for Granthera:

Entering the retail segment strengthens diversification, generates a steady flow of capital, and reinforces the company’s business model. Granthera builds an infrastructure where institutional and retail capital operate in sync, creating a new lending market — faster, safer, and more transparent than traditional banking.

Traditional banks are losing their monopoly on access to capital. The world is moving toward a financial system where money works without geographic or bureaucratic boundaries.

Granthera opens the door to the future, where every user becomes a full participant in the global financial ecosystem.