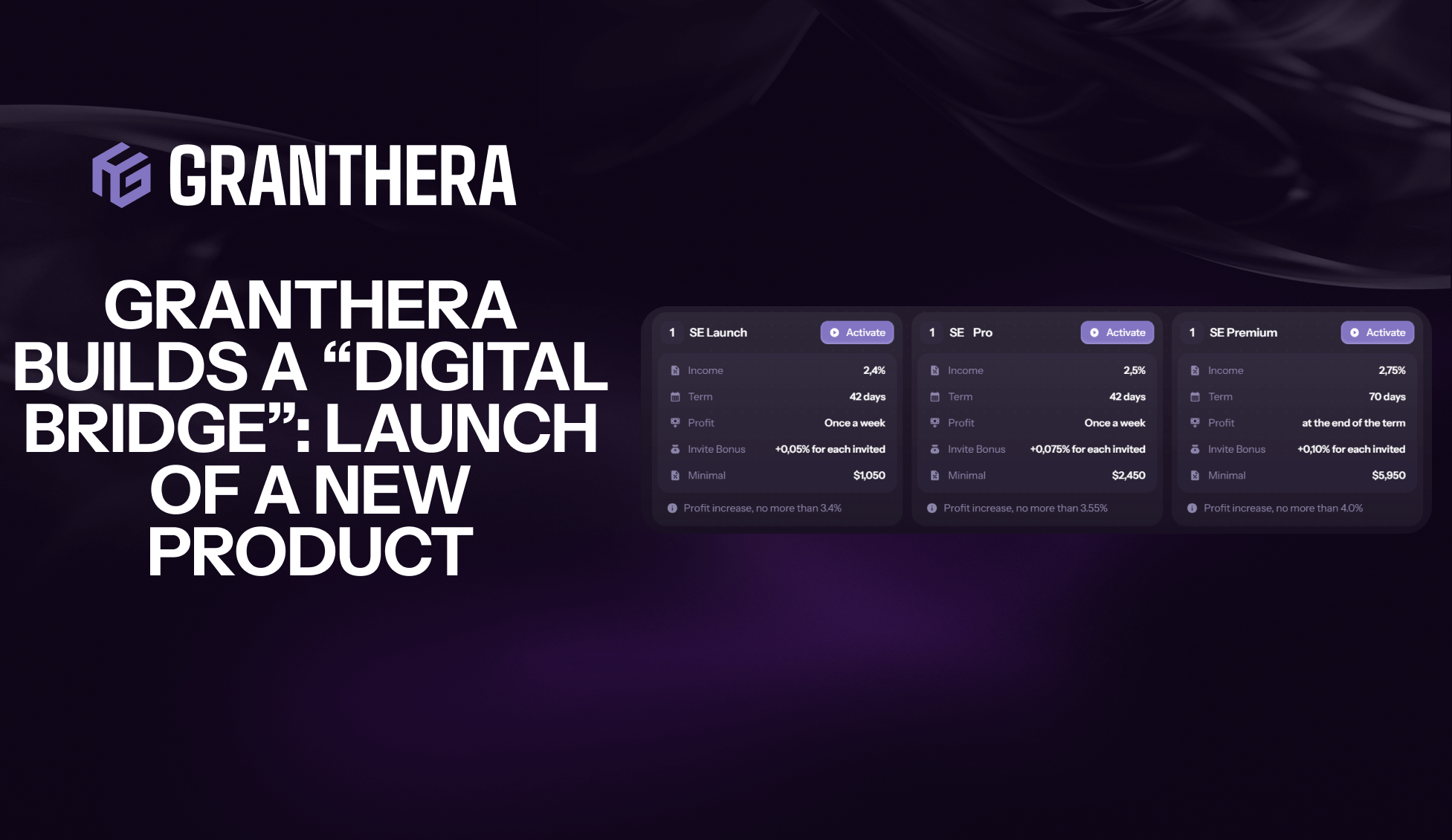

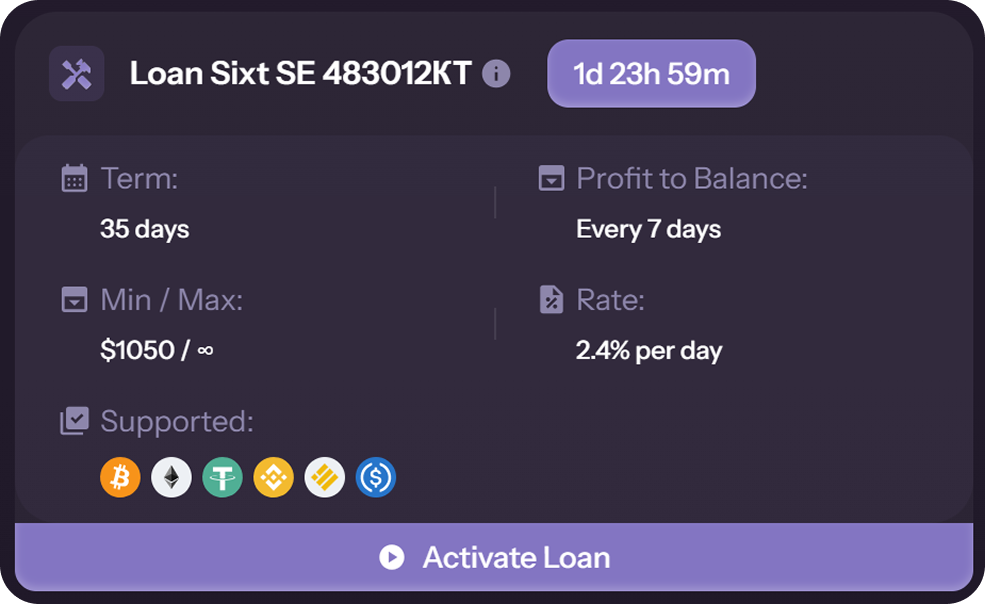

Granthera Group’s new investment initiative focuses on financing construction companies in key growth hubs—including Asia, Europe, and other dynamic markets.

Through its internal credit pool, Granthera supports residential and commercial development projects where demand consistently outpaces supply.

All borrowers undergo a multi-tiered vetting process, with risk assessment covering:

— Legal clarity of land assets

— Resilience to regional market fluctuations

— Predictability of post-construction demand

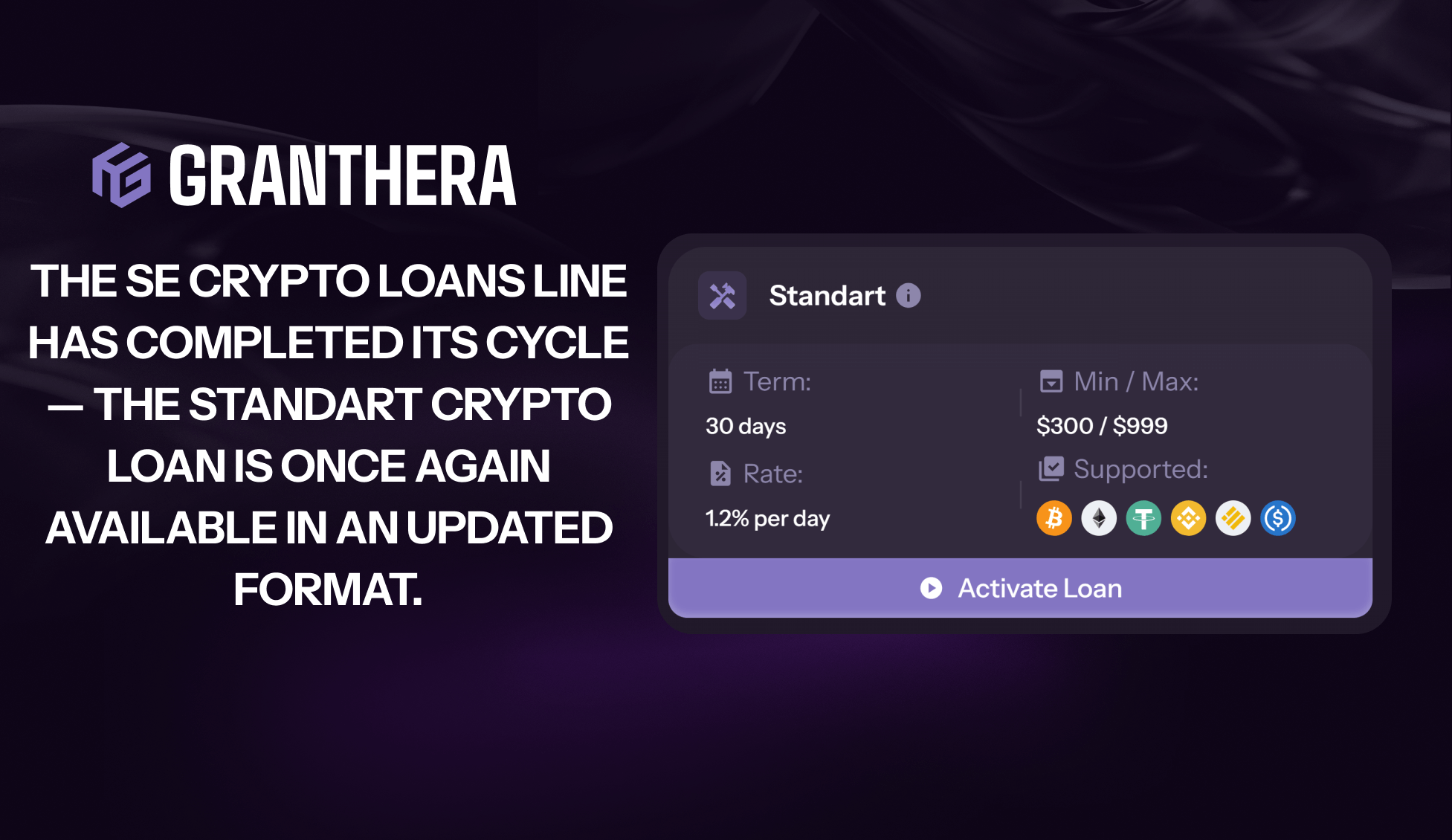

For digital asset holders, this unlocks a new form of yield generation rooted in the real economy, featuring transparent capital return structures and predictable cash flows.

Granthera continues to expand its infrastructure, bridging digital capital with the physical construction of tomorrow.